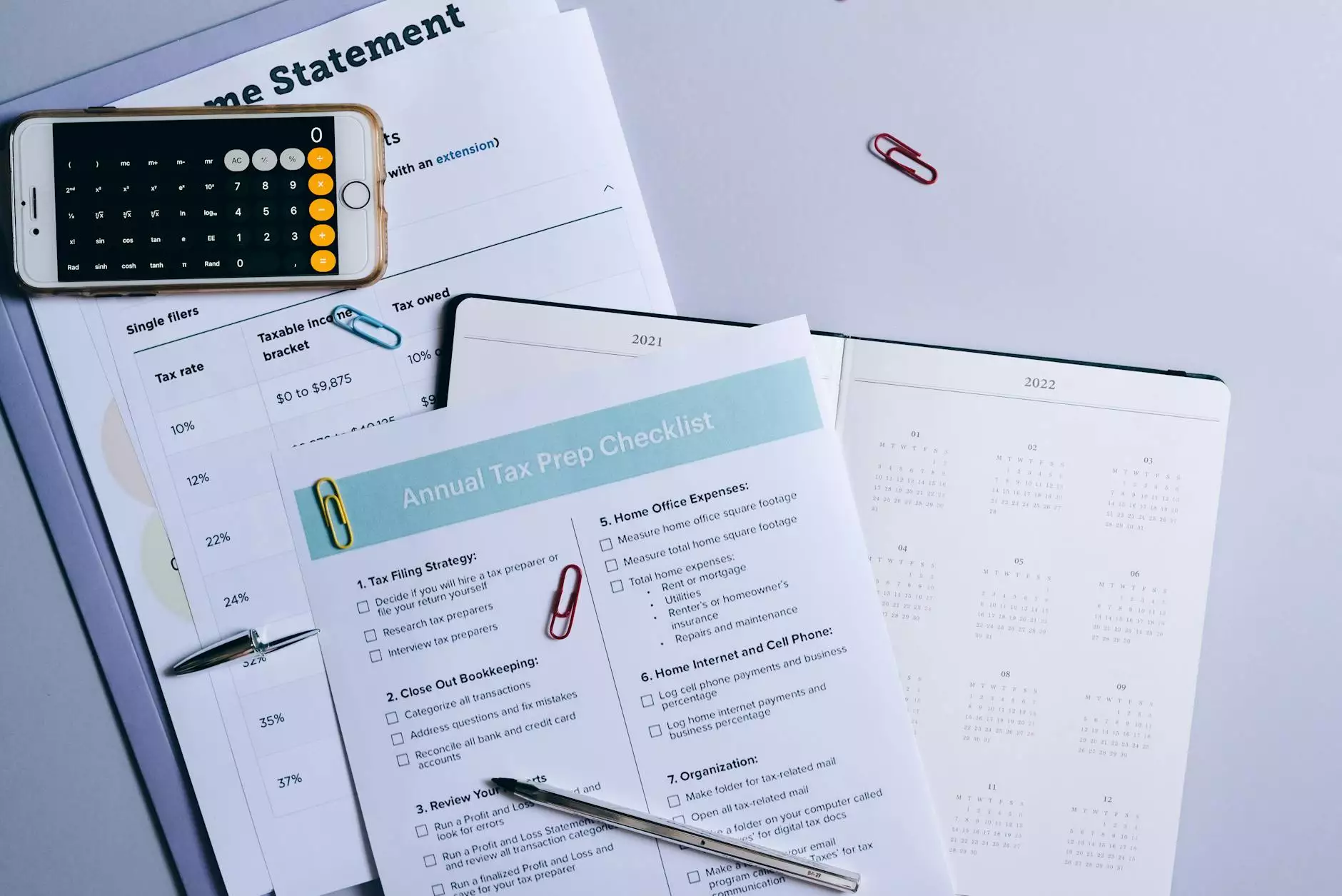

Understanding Bookkeeping Pricing: A Comprehensive Guide for Your Business

In today’s competitive business environment, one of the most crucial aspects of financial management is understanding bookkeeping pricing. As a business owner, whether you're running a startup or managing an established company, effective bookkeeping serves as the backbone of your financial health. In this extensive guide, we will explore the various elements that constitute bookkeeping pricing, helping you make informed decisions to benefit your business.

What is Bookkeeping?

Bookkeeping is the process of recording, storing, and retrieving financial transactions for a business, non-profit organization, or individual. It involves keeping track of all monetary transactions and ensuring that financial statements are accurate and up to date. It’s essential for:

- Tax Preparation: Organized records simplify the tax filing process.

- Financial Analysis: Proper bookkeeping allows for better financial analysis and decision-making.

- Business Planning: Having accurate records can aid in strategic planning and forecasting.

Factors Influencing Bookkeeping Pricing

Understanding the factors that influence bookkeeping pricing can help you determine what service you’ll need and what you should expect to pay. Here are some primary considerations:

1. Nature of Your Business

The type of business you operate significantly influences bookkeeping fees. For instance, businesses with complex financial transactions, such as those in the construction or manufacturing sectors, may incur higher costs than those dealing with simple transactions, like retail shops.

2. Volume of Transactions

The more transactions your business has, the more time a bookkeeper will spend keeping track of them. As a result, higher transaction volumes usually lead to increased bookkeeping costs. It's essential to keep this volume in mind when requesting quotes from bookkeeping services.

3. Complexity of Services Required

Basic bookkeeping might involve recording transactions and reconciling bank statements, while more complex services may include payroll management, tax planning, or financial forecasting. The latter services would typically have a higher price tag attached to them.

4. Your Location

Geographic location also affects bookkeeping pricing. Firms in urban areas may charge more due to higher operational costs. Conversely, firms in rural areas might offer more competitive rates.

5. Hiring Professionals vs. In-House

Choosing between hiring a professional bookkeeping firm or employing an in-house bookkeeper can drastically change costs. While in-house bookkeepers offer a dedicated resource, they come with additional costs such as salary, benefits, and training. Outsourcing bookkeeping services can provide flexibility and potentially lower overall costs.

Common Pricing Structures for Bookkeeping Services

Bookkeeping services can follow different pricing structures. Understanding these can help you choose the best option for your business:

1. Hourly Rate

Many bookkeeping services charge an hourly rate. This is a straightforward pricing model where clients pay for the actual hours worked. Rates can range from $20 to $150 per hour, influenced by the factors discussed earlier.

2. Monthly Retainer

A monthly retainer model involves paying a predetermined fee for a set of services over a month. This can be advantageous for businesses with ongoing, consistent bookkeeping needs and helps in budgeting.

3. Per Transaction Fee

Some firms may charge based on the number of transactions processed each month. This model works well for businesses that experience variable transaction volumes, allowing for flexibility in costs.

4. Flat Fee

A flat fee pricing model may be offered for certain services, such as monthly financial reporting or annual tax preparation. This structure provides transparency and predictability in costs.

Hidden Costs in Bookkeeping

While discussing bookkeeping pricing, it’s important to be aware of potential hidden costs that could arise:

- Initial Setup Fees: Some companies may charge for initial setup or onboarding tasks.

- Add-On Services: Services like payroll, tax filing, or extensive reporting may incur additional fees.

- Software Costs: If using specialized accounting software, subscription or licensing fees may apply.

How to Choose the Right Bookkeeping Service

Choosing the right bookkeeping service is vital for smooth financial operations. Here are key steps to guide your choice:

1. Assess Your Needs

Identify your specific bookkeeping requirements. Determine the complexity, volume, and frequency of transactions to understand what services you need.

2. Research and Compare

Look for reputable bookkeeping services in your area. Compare their offerings, experience, and pricing structures. Don’t hesitate to request quotes!

3. Check Qualifications and Experience

Ensure the bookkeeper or bookkeeping service is certified and has experience relevant to your industry. This can make a significant difference in service quality.

4. Review Client Testimonials

Look for reviews and testimonials from previous clients. This feedback can provide insight into the service provider's reliability, professionalism, and ability to deliver.

5. Schedule Consultations

Many bookkeeping firms offer free consultations. Take advantage of these to ask questions, gauge compatibility, and understand their approach to bookkeeping.

Benefits of Professional Bookkeeping

Investing in professional bookkeeping services can yield significant benefits for your business:

- Time Savings: Focus your time on growing your business rather than handling financial tasks.

- Expertise: Gain access to professional expertise, ensuring accurate and compliant record-keeping.

- Improved Financial Management: Enhanced tracking and analysis can lead to better business decisions and strategic planning.

- Stress Reduction: Eliminate the financial stress that comes from managing your bookkeeping without help.

Conclusion

In summary, understanding bookkeeping pricing is essential for making informed decisions regarding your business's financial management. By considering various pricing structures, services available, and hidden costs, you can select a bookkeeping solution that meets your needs effectively. The right bookkeeping partner not only ensures compliance and accurate financial reporting but also provides valuable insights for your business’s growth and success.

For more insightful financial services and expert bookkeeping guidance, visit BooksLA today. Empower your business with exceptional financial stewardship, ensuring a solid foundation for growth and prosperity.