How Software Development Can Revolutionize Your Finances

Welcome to Duckma.com, where we believe in the power of innovative software solutions to transform businesses across industries. In this article, we will explore the significant impact of software development in the field of finance and how it can revolutionize your financial operations. By leveraging cutting-edge technology and customized software solutions, you can gain a competitive edge in the market.

The Evolution of Finance and the Need for Software Solutions

The finance industry has undergone tremendous changes in recent years. With increasing competition, complex regulations, and the demand for real-time data analysis, businesses in the finance sector must adapt to stay ahead. This is where software development comes into play. By developing tailored software solutions, finance companies can streamline their operations, enhance productivity, and deliver a seamless customer experience.

Benefits of Software Development in Finance

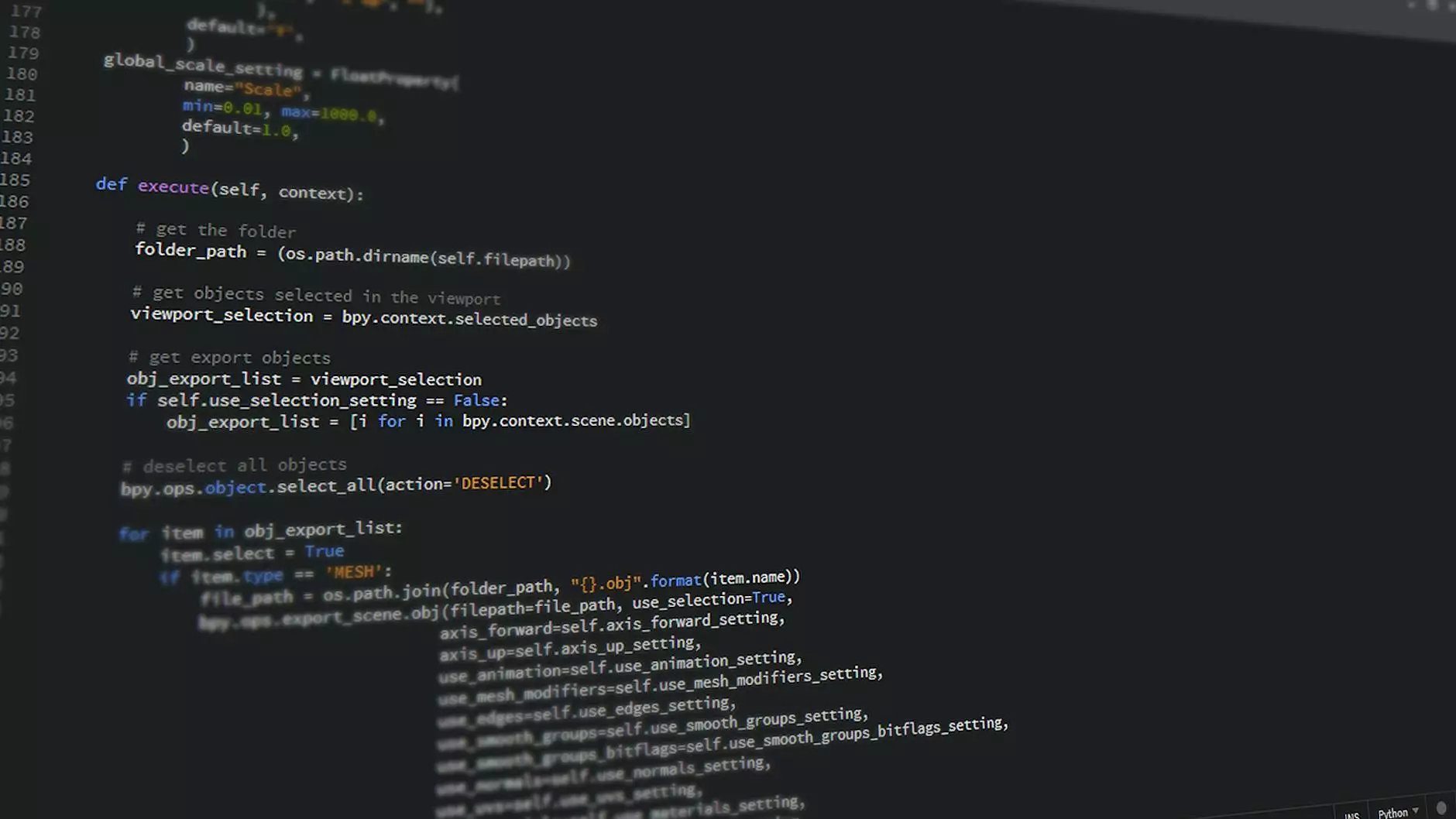

1. Improved Efficiency and Accuracy: Manual processes are prone to errors and can be time-consuming. With software development, finance tasks can be automated, reducing the risk of errors and improving overall efficiency. Advanced algorithms can process complex calculations with ease, saving valuable time for your organization.

2. Real-time Data Analysis: In the finance industry, data plays a crucial role in decision-making. Software solutions can gather, process, and analyze vast amounts of data in real-time. This enables businesses to make informed decisions faster, leading to better financial outcomes.

3. Enhanced Security: Cybersecurity is a top concern in the finance sector. Custom-built software solutions can incorporate robust security measures, reducing the risk of data breaches and unauthorized access. Protecting sensitive financial information is critical for maintaining customer trust and complying with data protection regulations.

4. Streamlined Processes: From payment processing to loan management, software development can streamline various financial processes. By automating repetitive tasks, businesses can allocate their resources more effectively and focus on higher-value activities. This not only increases productivity but also improves customer satisfaction.

Software Solutions for Financial Institutions

Financial institutions, such as banks, investment firms, and insurance companies, can greatly benefit from software development solutions. Here are a few areas where software solutions have made a significant impact:

1. Automated Trading Systems

Using sophisticated algorithms, automated trading systems enable financial institutions to execute trades more efficiently. These systems can analyze market trends, monitor multiple data streams, and place trades in real-time. With reduced human intervention, the risk of trading errors is minimized, leading to better investment outcomes.

2. Risk Management Software

Managing risk is essential for financial institutions. Custom-built risk management software solutions help in identifying, assessing, and mitigating risks effectively. From credit risk to market and operational risks, software tools can provide valuable insights and enable proactive risk management strategies.

3. Payment Processing Solutions

In today's digital world, seamless payment processing is crucial for businesses. Software solutions can integrate various payment methods, facilitate secure transactions, and provide real-time payment tracking. Whether it's online payments, mobile wallets, or point-of-sale terminals, customized software can streamline payment processes and improve transaction efficiency.

Incorporating Software Development in Finance: Key Considerations

When implementing software development for finance, certain factors must be considered to ensure successful integration and maximize benefits:

1. Define Your Objectives

Clearly identify your business objectives and determine how software development can align with them. Whether it's reducing costs, improving customer experience, or enhancing data security, having a clear roadmap will guide the development process.

2. Customize for Your Needs

Off-the-shelf software may not meet the specific requirements of your finance business. Collaborate with experienced software developers who can create customized solutions tailored to your unique needs and challenges. This will give you a competitive advantage and help differentiate your business.

3. Ensure Scalability and Integration

Choose software solutions that are scalable as your business grows. Additionally, ensure that the developed software integrates seamlessly with your existing IT infrastructure, minimizing disruptions and maximizing efficiency.

Conclusion

Software development has the power to revolutionize your finances, providing you with the tools to thrive in a rapidly evolving industry. By harnessing the benefits of customized software solutions, financial institutions can automate processes, analyze data in real-time, enhance security measures, and streamline operations. With Duckma.com, you have access to top-notch software development services that can give your business a competitive edge and fuel growth in the dynamic field of finance.

Remember, embracing software development is not just a trend; it's a necessity in today's digital world. Stay ahead of the competition and embark on a transformative journey for your finance business with Duckma.com.

software development finance